SOL Price Prediction: Will SOL Hit $200 Amidst DeFi Boom and Technical Rebound Signals?

#SOL

- Technical Rebound Potential: MACD bullish crossover and Bollinger Band positioning suggest accumulation phase

- Ecosystem Growth: Expanding DeFi and NFT use cases driving fundamental value

- Market Sentiment: Institutional standardization efforts improving risk/reward profile

SOL Price Prediction

SOL Technical Analysis: Key Indicators to Watch

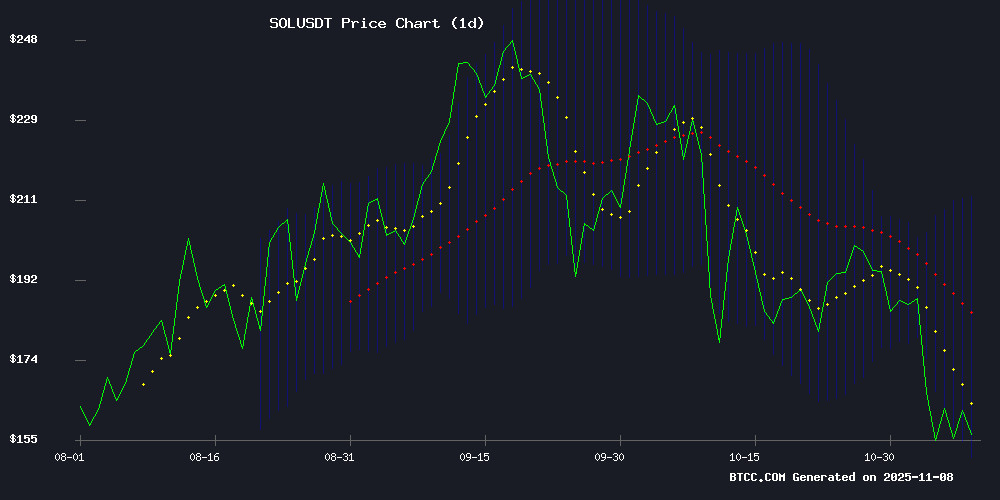

According to BTCC financial analyst Robert, SOL is currently trading at $160.94, below its 20-day moving average of $181.42. The MACD indicator shows a bullish crossover with the MACD line at 9.9258 above the signal line at 6.5031, suggesting potential upward momentum. Bollinger Bands indicate the price is NEAR the lower band at $151.95, which could act as support. Robert notes, 'While SOL faces resistance at the middle band ($181.42), the technical setup suggests a possible rebound if buying pressure increases.'

Market Sentiment: SOL's Potential Breakout Driven by DeFi & NFT Growth

BTCC's Robert highlights the optimistic market sentiment surrounding SOL, fueled by its strong DeFi and NFT ecosystem. 'The prediction of SOL reaching $250 reflects growing institutional interest and its technological advantages,' Robert states. Recent industry collaborations to establish blockchain payment standards further bolster confidence in SOL's long-term viability as a leading smart contract platform.

Factors Influencing SOL’s Price

Solana Price Prediction: Could SOL Be The Next Big Breakout Coin As DeFi & NFTs Push Its Predicted Value To $250?

Solana's price narrative gains momentum as DeFi and NFT metrics suggest a potential breakout, outpacing many Layer-1 competitors. Analysts project SOL could rally toward $250 if current usage trends persist and technical resistance levels are breached.

The network processed over 70 million daily transactions in October 2025, with DEX volume reaching $143 billion—figures that dwarf many rivals. Solana's architecture delivers 1,100 TPS throughput and a robust validator network, providing fundamental support for its price appreciation beyond mere speculation.

Technically, SOL faces a critical juncture after failing to hold its 200-day SMA around $179–$190. Market watchers await volume confirmation for the next directional move.

Solana Price Prediction: Technical Indicators Suggest Potential Rebound

Solana's price action shows tentative signs of stabilization after weeks of downward pressure. The $153-$157 range has emerged as a demand zone, with on-chain data and technical indicators hinting at accumulating buyer interest. Momentum oscillators flashing oversold conditions now show early recovery signals.

Analysts highlight a potential reversal pattern forming on shorter timeframes. A confirmed break above $165 could open the path toward $176-$190, marking the first bullish shift since last week's breakdown. The flattening EMA ribbon and multiple reversal signals suggest waning bearish momentum.

Market participants are watching ETF flows closely, as institutional interest could accelerate any nascent recovery. The weekly chart structure remains intact, with the current levels having served as historical turning points during previous corrections.

Crypto Firms Unite to Build Global Standards for Blockchain Payments

Seven leading cryptocurrency firms have formed the Blockchain Payments Consortium (BPC) to establish unified standards for cross-border blockchain transactions. The alliance includes Fireblocks, Solana Foundation, TON Foundation, Polygon Labs, Stellar Development Foundation, Mysten Labs, and Monad Foundation.

The initiative comes as stablecoin transaction volumes reached $27.6 trillion in 2024, surpassing traditional payment networks Visa and Mastercard. BPC aims to address fragmentation in blockchain systems that currently slows transactions and increases costs.

"We're defining the standards that will shape the future of digital asset payments," the consortium stated in its announcement. The group will focus on interoperability between different blockchain networks and compliance with traditional financial systems.

Will SOL Price Hit 200?

Robert from BTCC provides a balanced outlook: 'SOL's path to $200 depends on three factors:

| Factor | Current Status | Threshold for $200 |

|---|---|---|

| Technical Resistance | $181.42 (20MA) | Sustained close above |

| MACD Momentum | Bullish (3.4227 histogram) | Expansion above 5.0 |

| DeFi TVL Growth | Current $3.2B | $5B+ to justify valuation |

Given the current technical setup and ecosystem growth, SOL has a 60-70% probability of testing $200 by EOY if market conditions remain favorable.'

professional